A Cafeteria Plan Could Include Which of the Following

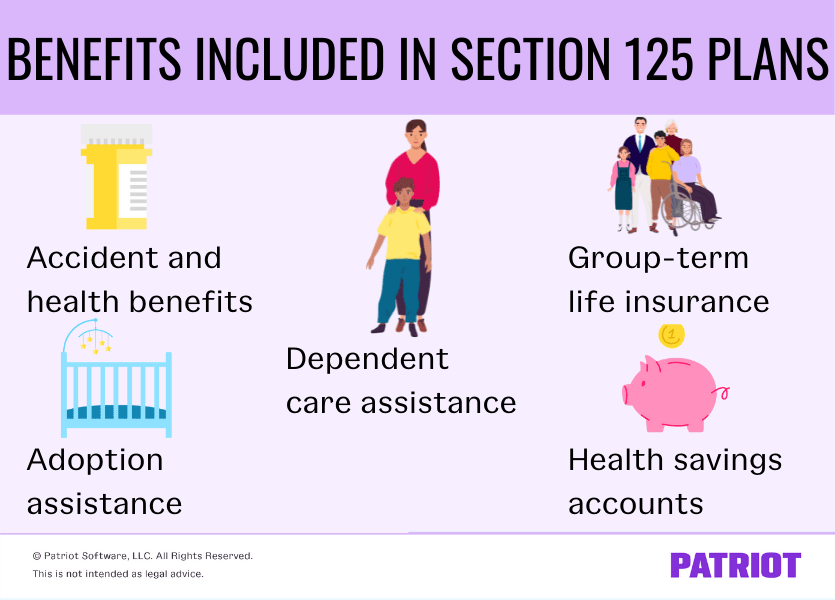

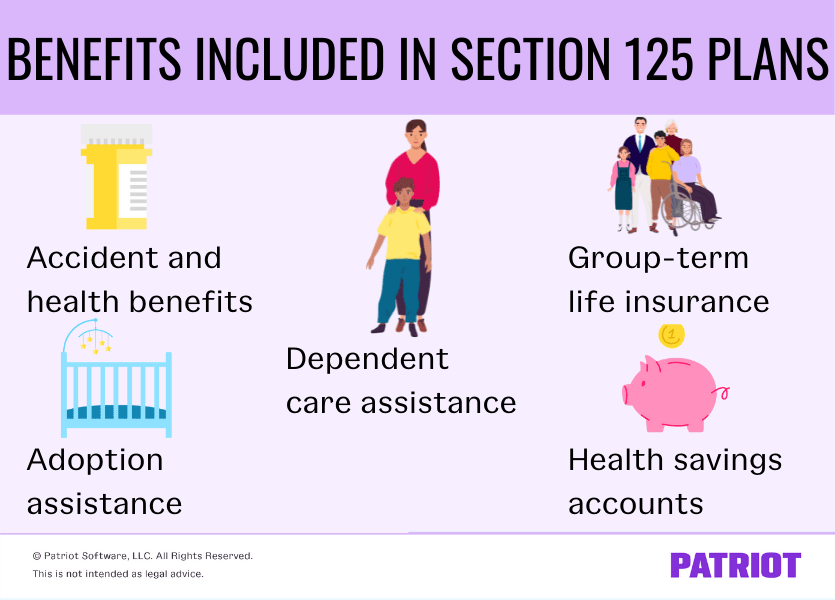

Generally a cafeteria plan does not include any plan that offers a benefit that defers pay. Cafeteria plan selections include insurance options such as health savings accounts HSAs contributions group term life insurance and disability insurance.

Paying or reimbursing expenses for qualified benefits incurred before the later of.

. Group term life insurance that exceeds 50000 of coverage is subject to Social Security and Medicare taxes but not FUTA tax or income tax withholding even when provided as a qualified benefit in a cafeteria plan. Examples of cafeteria benefits plans. A cafeteria plan can include which of the following qualified.

The term cafeteria plan means a written plan under which A All participants are employees. O Employer-provided cell phones. O Indefinitely Mark for follow up Question 16 of 35.

It allows employees to put aside a portion of pre-tax salary for certain healthcare products and services. Coverage under an accident or health plan which can include traditional health insurance health maintenance organizations HMOs self-insured medical reimbursement plans dental vision and more. New elections for employer-sponsored health coverage by employees who.

A Section 125 plan or a cafeteria plan allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences. 305 395 Benefits that are excluded from a cafeteria plan include. Cafeteria plans may not have a plan year that.

A Cafeteria plan is a tax-free benefit program which is allowed under Section 125 of the Internal Revenue Code. Qualified benefits under a cafeteria plan deferral amounts are not subject to FICA FUTA Medicare tax or income tax withholding. Also certain life insurance plans maintained by educational institutions can be offered as a benefit even though they defer pay.

All of the above. B employees can select benefits that best match their needs. Brought to you by Sullivan Benefits 1.

And B The participants may choose among 2 or more benefits consisting of cash and qualified benefits In the August 2007 proposed regulations the IRS stated that plans could offer a taxable. Generally a cafeteria plan doesnt include any plan that offers a benefit that defers pay. They also include employee group-term life insurance coverage that is includable in income solely because the coverage exceeds 50000.

Only certain benefits can be offered through a cafeteria plan. Cafeteria plan elections must generally be made before a period of coverage begins and remain unchanged during the period of coverage. Examples of cafeteria-style benefits plans include the following.

If a Section 125 cafeteria plan provides more than 25 percent of its nontaxable benefits excluding group term life insurance in excess of 50000 to key employees then each key employee includes in gross income an amount equaling the maximum taxable benefits that he or she could have elected for the plan year. Benefits eligibility under a cafeteria plan including this Cafeteria Plan or other employee benefit plan of you your Spouse or your Dependents. Nondiscrimination Tests for Cafeteria Plans.

Cafeteria plans typically provide medical and life benefits. Cafeteria plans can be structured to meet a variety of employee benefit needs. This was enacted by Congress to help lower your cost by making these expenses tax-exempt from Federal State and FICA taxes.

C reduced taxes for employees. However a cafeteria plan can include a qualified 401 k plan as a benefit. Dependent care assistance benefits or DCAPs Group term life insurance.

A cafeteria plan can include which of the following qualified benefits. A cafeteria plan can only offer pre-tax benefits like health and dental benefits for employees spouses children who are under age 27 as of the end of the taxable year and individuals who otherwise qualify as an employees tax dependents for. Also certain life insurance plans maintained by educational institutions can be offered as a benefit even though they defer pay.

Termination or commencement of employment. O Dependent care assistance. D greater employer control over increasing benefit costs.

However a cafeteria plan can include a qualified 401k plan as a benefit. A cafeteria plan is a separate written plan maintained by an employer for employees that meets the specific requirements of and regulations of section 125 of the Internal Revenue Code. This is also known as a Premium Only Plan POP.

Other popular selections include. It provides participants an opportunity. 394 Advantages of a cafeteria plan include.

Mark for follow up Question 17 of 357. The plan allows participating individuals to pay for certain expenses with tax-free dollars. A commencement of or return from an unpaid leave of absence.

During 2020 and 2021 cafeteria plans could permit one or more of the following prospective election changes for any reason. A cafeteria plan includes any arrangement allowing participants to choose among two or more benefits consisting of cash which is broadly interpreted for this purpose to include a list of permitted taxable benefits annual leave sick leave paid-time-off and severance pay and a series of other qualified benefits covering specific benefits that are nontaxable under a tax. Cafeteria plans are relatively simple to design and administer.

Such events include any of the following changes in employment status. Examples of failures resulting in section 125 not applying to a plan include the following A. Only a and c.

A strike or lockout. Statutory nontaxable benefits are qualified benefits offered through a cafeteria plan that are excluded from gross income eg health and dependent care benefits. 35 Advantages of cafeteria plans include all of the following EXCEPT A simplicity of benefit administration.

To receive this tax advantage the cafeteria plan must generally pass the following three nondiscrimination tests. With regard to Health FSAs a cafeteria plan may include the grace period rule the carryover rule or neither rule but may not include both rules. Failure to operate according to written cafeteria plan or section 125.

The period of coverage is usually the 12-month cafeteria plan year but may be a shorter period of time for a newly eligible employee or a new cafeteria plan.

Start The School Year Off In The Right Direction By Encouraging Proper Lunchroom Behavior These Posters Include K Lunch Room Cafeteria Behavior Behavior Plans

What Is A Section 125 Plan Definition Benefits More

Weekly Menu Planner Week 3 Easy 7 Day Menu Menuplanning Food Eat Nutrition Healthyeating Healthyfood H Weekly Menu Planners Kids Menu Toddler Menu

No comments for "A Cafeteria Plan Could Include Which of the Following"

Post a Comment